- 4.7 Instructor Rating

- 9 Courses

Enhancing your investment portfolio and client conversation

Socially Responsible Investment and Corporate Social Responsibility have gained more attention in recent years. As more corporate and accounting scandals are exposed, calls for better corporate governance and responsible business practices also grow louder.

Investors have also become more educated and sophisticated, hence, there is increased demand for investments that reflect their values be it from a religious, moral, environmental or social standpoint.

When is it good business practice to invest for social good? What are the most innovative and effective business strategies for bringing about positive social impact?

By gaining an overview of the current landscape of impact investing in this training course, you will learn how you can play a role in the emerging sector. You will also have a deep understanding of the subject by analysing the range of investing and funding approaches used by impact investors.

Chairman and Founder, TBLI Group, Member of Advisory Council, Wealth and Society

Robert Rubinstein, chairman and founder of TBLI (Triple Bottom Line Investing) Group, has been instrumental in building the environmental, social, and governance (ESG) and impact investing ecosystem, even before these terms were coined. He taught courses in sustainable finance at the Rotterdam School of Management from 2003-2006, and delivered numerous lectures at international business schools and universities throughout his career. TBLI is a leading global ESG/impact investing network that has been educating, advising and connecting investors for 25 years.

Reclaim Finance and more than 15 NGOs launch the “Oil and Gas Policy Tracker” (OGPT). The tool is the first of its kind: it assesses in great detail the oil and gas exclusion policies (or lack thereof) of the 150 biggest financial institutions worldwide.

Ripple, one of the leading enterprise blockchain and crypto solutions announced its commitment of $100 million to carbon markets. The funding will accelerate carbon removal activity and help modernise carbon markets through investments in innovative carbon removal companies and climate-focused fintechs.

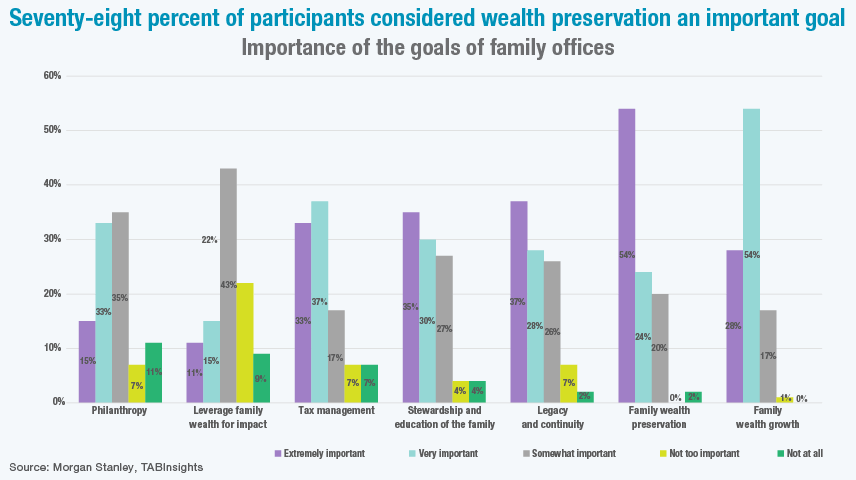

A whitepaper just released by Honghu Best Global Family Office and The Asian Banker, "Global Family Office and Wealth Management Best Practices 2021 - Global Perspectives, Chinese Flair" reveals that succession planning is critical to intergenerational wealth transfer. However, most families do not prepare or plan for a smooth transition, leading to the partial or even full loss of wealth or family values that need to be passed on.